Is College Worth the Cost in 2018?

Want to know whether college is still worth it in 2018?

Here’s a crazy fact: If you add up all of the student loan debt in the US, it reaches over $1.4 trillion dollars. It’s hard to visualize just how much a trillion dollars is.

But here’s an idea:

A trillion dollars laid out next to each other would reach the sun. Likewise, a trillion dollars is nearly the amount of money currently in circulation in the entire country.

Currently, the average college student graduates with $31,000. Paying off the burden of student loans can take decades, depending on what field you work in post-college and how much total debt you take on. For one thing, graduate, law, and medical degrees rack up significantly more tuition than a 4-year undergraduate degree.

If you add up the costs, is college really worth the debt today? Let’s weigh in.

College is Expensive

While the costs for tuition and books have steadily increased over the last 30 years, so has the value of a college degree.

How so?

Well, the average starting salary for a college grad has never been higher. According to Time, the average pay for new college graduates is right around $50,000.

(Want to find out how much the Class of 2018 is really earning? Click here to find out.)

So this means that yes, we’re paying more to attend college. But we’re also getting more opportunity from it than our parents or the generations before us.

A recent study conducted by Georgetown University found that people who graduate from college earn around $17,000 more per year than high school graduates. That adds up to a million more over your lifetime. Considering we need between $1 million to $1.5 million saved up to retire, attending college can help secure your future.

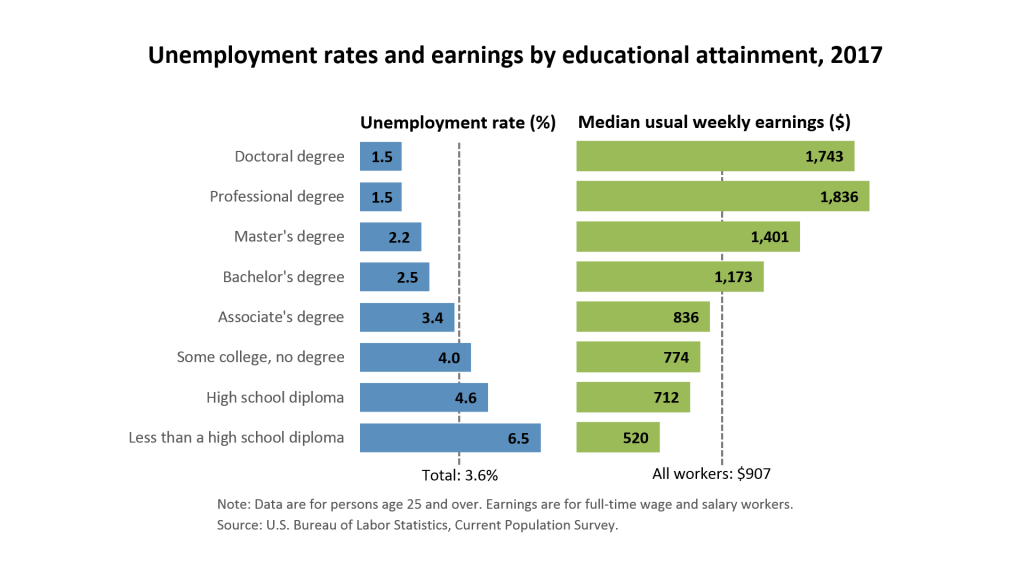

This graph from the Bureau of Labor Statistics compares the average weekly pay and unemployment rates based on your level of education.

College is a Gamble

We already know that some college degrees will pay off faster than others. The average salary in technology, medicine, or science is going to much higher than a starting salary in arts or humanities.

That doesn’t mean we shouldn’t pursue arts if that’s our passion. But should we go the route of student loans in that case?

It’s a gamble.

If you decide to pursue one of these routes--like sociology, arts, psychology, or political science--consider how much you’ll realistically earn in 5-10 years before you take out student loans. In this case, it’s probably wiser to seek financial aid in the form of scholarships. The debt isn’t worth it.

Not All Debt is Bad

Having a little bit of debt can actually be beneficial.

After all, taking out student loans, car payments, or credit cards is how you start to build your credit history.

If you’ve never borrowed money, you don’t have any credit. This makes it harder to take out a loan for large purchases in the future--like when you’re ready to buy a house

When you make on-time payments on your debt, you’re demonstrating you can borrow money responsibly and pay it off. I saw this happen first hand when I paid off my first car and my credit score jumped up to excellent!

I still have a significant amount left on my student loans, but my credit has never looked better.

However, I wish I had known exactly what I was getting myself into when I borrowed money in college. Nobody really explained student loans to me, they just let me rack up debt with no questions asked. The Graduate Survival Guide: 5 Mistakes You Can't Afford To Make In College is a fantastic resource for high school seniors or any students who want to understand their financial decisions better.

In Conclusion

Is college worth it today? That is ultimately your call to make, but I think it’s absolutely worth every penny. If I could do it all over again, I’d still go back to college.

What do you think? Let us know in the comments below.

Resources

The Graduate Survival Guide: 5 Mistakes You Can't Afford To Make In College by Anthony O'Neal

Student Loan Planning: A Borrower's Guide to Understanding and Repaying Student Loan Debt by Ryan H Law

Paying for College Without Going Broke, 2018 Edition: How to Pay Less for College (College Admissions Guides) by Princeton Review