The Worst Money Mistakes Students Make In 2021

Are you tired of making the same money mistakes as everyone else? Want to avoid the most common pitfalls students fall into every day?

As a student, there's no doubt that you've at least heard of the stereotypical starving student.

You know, the student who eats nothing but Ramen noodles for breakfast, lunch, and dinner. And, who only earns enough just money to pay their bills, without their work life having a negative impact on their studies.

Unfortunately, this stereotype is all-too-common among college and university students.

No matter how you look at it, it can be challenging to balance your school work with financial responsibility. Especially when you're first starting out in college or university,

And that's why we thought it'd be a great idea to create the following blog post on the top 5 worst money mistakes students make every semester.

Keep reading, and below, we explore what you should avoid doing with your money while you're in college or university.

Eating Out Too Often

Restaurants are a great place to gather with family, friends, and loved ones.

Plus, they're convenient, which makes them powerfully alluring, especially for students with their already-busy schedules.

However, restaurants are also expensive.

To illustrate how expensive it can be to eat at a restaurant, consider this:

The average at-home meal only costs you about $4 or $5 in groceries, and you usually still end up with leftovers.

On the other hand, a meal at a restaurant, on average, costs about $14, which is a staggering 325% more expensive than your $4 meal at home.

Plus, there's also the expectation that you should tip your server when dining at a restaurant.

This only adds to the amount of money you're wasting.

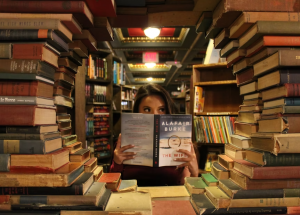

Instead of wasting your money at restaurants, it's a better idea to hit up your local library.

Or browse a book store and find a few cookbooks that seem interesting.

Get creative, try new foods, and in no time, you'll learn to appreciate that eating at restaurants isn't all as cracked up as it's thought to be.

Ordering Take Out Too Often

With the handful of food delivery apps on the market today, it's easier than ever to order your next meal. This saves you both time and effort during your already-hectic school weeks.

But, just like eating at restaurants, ordering take out food is expensive and overpriced.

Plus, you're also expected to add a tip or gratuity to your delivery person, adding to the overpriced cost of take out.

Whether you dine in or order take out, restaurant food is ALWAYS going to cost you more than a visit to the grocery store.

And most times, what you order will only feed you for a single meal.

Therefore, instead of opening Uber Eats and ordering delivery from the restaurant up the street, it's a better idea to spend that money on food from the grocery store.

Drinking Alcohol And Partying

Just because you're studying in college or university doesn't mean that you shouldn't go out and have fun with your friends.

However, it does mean that you should keep a watchful eye on how much you're spending on alcohol, marijuana (if it's legal where you live), and going out at night.

Especially if you're going to a local bar or club! Understand that these places serve food and drinks to make a profit.

Meaning that they are considerably more expensive than if you were to buy and consume these things at home.

Don't deny yourself the ability to go out and have fun. But do make sure you're not spending more money than you can afford.

Whether you're going to the campus pub to meet with friends, family, or a steamy blind date, your money can truly be spent better elsewhere.

High-Interest Credit Cards

As soon as you came of age, you were probably offered a credit card.

Usually from your bank explaining that it will help build your credit score for the future.

Of course, using a credit card and paying it off immediately is a great way to help build your credit score and access more credit in the future.

However, using credit can also be a slippery slope.

So always remember that it's easy to spend your credit, but much harder to pay it back!

Especially when you're dealing with credit cards that have interest rates ranging anywhere from 19% to 30% or more!

Of course, having credit available is a good idea in case of emergencies.

But if you need to use credit, it's much more financial responsible to look into a student line of credit. Or, even a personal loan, which will usually have a much lower interest rate.

Not Saving Or Investing For The Future

Finally, another of the biggest mistakes students make is simply spending too much and not putting anything aside for the future.

Whether you're in your first year of post-secondary or your last year, it's vital that you start saving your money.

You might want to consider investing your money in stocks, bonds, or mutual funds.

Or, in the very least, start putting some money aside that you'll allow yourself to touch for emergencies or once you're graduated.

The Worst Money Mistakes For College And University Students

Of course, there are many other things that you can waste your money on foolishly.

However, eating overpriced food, drinking too much, using high interest credit, and not saving for the future are some of the most common expenses that are considered as wasteful.

It might be hard to keep a watchful eye on your finances, especially when you're busy with school.

But, if you start taking control of your money now, I promise, you'll thank yourself later!