Budgeting Tips For Students

Looking for student budgeting tips? Then, you've come to the right place.

Whether you’re in college or university, it’s high time that you learn how to start budgeting your finances.

It’s no secret that first-year students are prone overspending on books, take-out and study supplies.

But by creating and maintaining a budget throughout the year, you’ll be much better able to manage your expenses and set yourself up for financial success in the long run.

Better Budgeting Tips

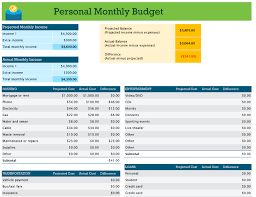

While you’re in school, it’s a good idea to keep a detailed logbook of your weekly or monthly expenses. Keep track of this by writing it down every time you spend any money.

Then, you’ll be able to subtract these expenses from your income to see whether you’re spending within your means.

Don’t be too alarmed if you come up with a negative balance. It’s important to use this information to help you review your spending and see where you can cut back on your spending.

For example, you might notice that you’re spending an awful lot of take-out food.

Or, you might even realize that no amount of cutting back is going to help and that you need to earn more money. In that case, a part-time job might be the best solution.

Having a part-time job can help you better afford your expenses. And part-time jobs are also much likelier to offer a flexible schedule to fit around your classes.

Learn more budgeting tips here.

Learn About Student Lines Of Credit

Not all credit is created the same. While it’s best to avoid paying your bills with a credit card, using a student line of credit is often a good choice for students struggling to make ends meet.

Obtaining a student line of credit allows you to access a pre-established amount of cash every year while in school. You’ll still be required to make regular payments on the interest. But you’ll be able to wait until after you graduate to pay back the principal in full.

And again, it’s best to avoid using credit cards at all costs. They have much higher interest rates and charge hefty cash advance fees, making it much harder to pay off your balance.

Negotiate Better Rates

We often overlook the cost of our cable and cellphone bills when dealing with our monthly expenses. But the truth is that these services often represent a significant portion of our monthly spending.

So with that said, it might be worth it to try and call your cable or cell service provider to see if you can negotiate better rates. If not, you might want to see about dropping a service or two to help lower your monthly bill.

After all, do you really need that extra gig of data?

Avoid Eating Out - Budgeting Tips

When you’re in school, especially if you’re juggling a part or full-time job at the same time, it can often feel like it’s impossible to take the time to cook a meal from scratch.

But restaurants and take-out food are expensive, and it’s easy to spend an entire month’s grocery budget by eating out just a few times.

So instead, try your best to do groceries and pack lunches instead of grabbing food on the go.

It might also be a good idea to create a separate grocery budget by figuring out what foods you’ll need for the month. Then, create a list of what to buy before heading out to the store and stick to it at all costs.

Read more student budgeting tips here: https://www.gobankingrates.com/saving-money/budgeting/budgeting-tips-college-students/

Think Before You Spend

Impulse purchases can be extremely tempting. But they’re also the purchases that we tend to regret almost as soon as we’ve made them.

That’s why we suggest waiting at least 24 hours before making any major purchases.

If the item is something that you truly need, you’ll stick likely still want to make the purchase after waiting a day.

But giving yourself a day to think about the purchase will allow you to decide whether it is something you truly need, or if it’s only something that you want.

It might be hard to deny buying yourself something new, but at the end of the month, when your spending is still within your means, you’ll thank yourself for it.

Buy Used or Digital Textbooks

It’s no secret that textbooks are often one of a student’s biggest expenses.

That’s why it’s a good idea to either buy used textbooks or do away with hardcopies completely and go digital.

There are many places where students can go to look for pre-used, afforable textbooks and there is also an increasing number of schools that are offering digital copies of textbooks.

Not only will you be saving yourself money, but you’ll also be helping to reduce your impact on the environment.

Put Money Aside - Budgeting Tips

The next item on our list of budgeting tips is to put some money aside and save it.

You never know when you’re going to run into hard times.

And this is exactly why we recommend trying to put aside at least 10% of your monthly income and not touch it unless absolutely necessary.

Think about it as an emergency fund.

So whether your car unexpectedly breaks down one day or you simply need help coming up with your share of the rent next month, you won’t have to go calling mom or dad to beg for a handout.

Struggling With Student Debt?

If you’re struggling with debt or need budgeting advice, don’t wait to find help.

If you’re facing any type of financial difficulties, it’s important that you speak to a school or financial counselor as soon as possible. They’ll be able to advise you on any issues you may be having and point you in the right direction to help you get back on track.